Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is 1651-0016. The estimated average time to complete this application is 22 minutes. If you have any comments regarding the burden estimate you can write to U.S. Customs and Border Protection, Office of Regulations and Rulings, 90 K Street NE, Washington DC 20229.

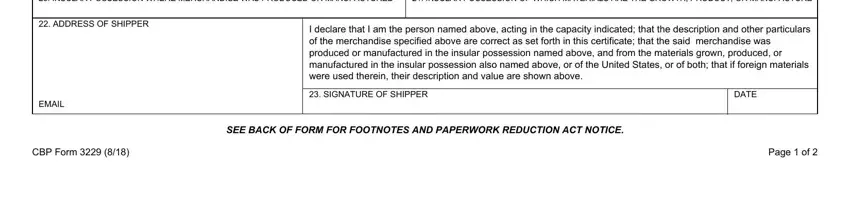

|

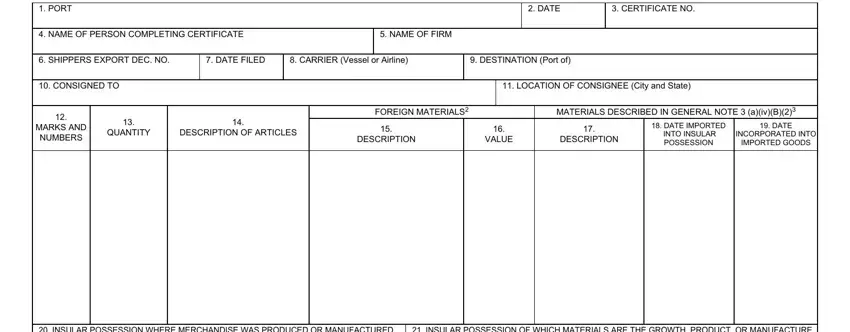

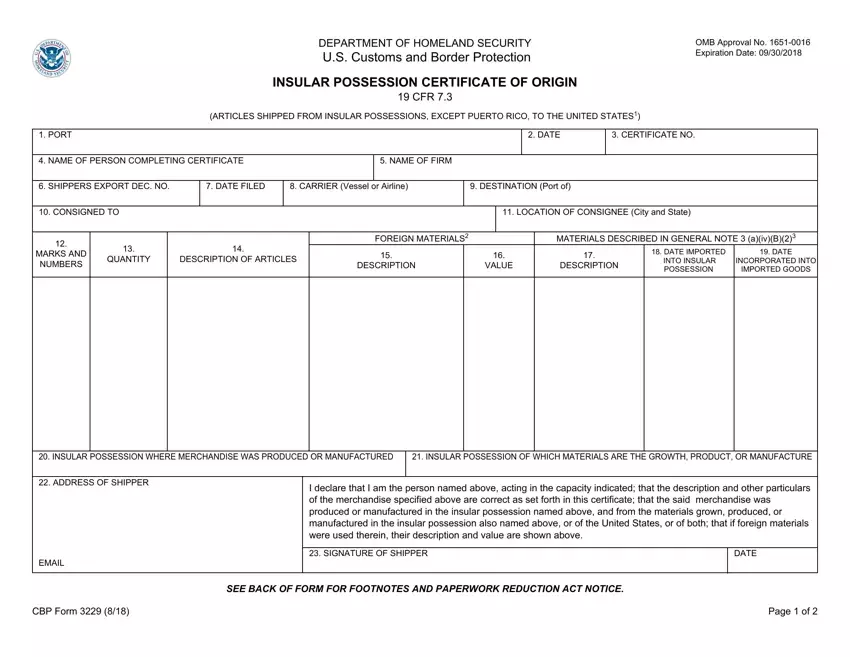

1 General Note 3(a)(iv), Harmonized Tariff Schedule of the United States (HTSUS). |

cost of transporting those materials to the insular possession, but excluding any |

|

2 Each "foreign material" (i.e., a material which originated in sources other than an insular |

duties or taxes assessed by the insular possession and any charges which may |

|

accrue after landing; |

|

possession or the United States) shall be listed on a separate line under columns 15 and |

|

If the materials used in an article originated only in an insular possession or the |

|

16. |

Columns 15 and 16 do not apply to materials which are not considered "foreign" |

|

under General Note 3(a)(iv)(B)(1), (2), HTSUS. |

United States, state "none" in column 15 and leave column 16 blank. |

|

"VALUE" as used in this certificate, refers to the sum of (a) the actual purchase price of |

3 Columns 17, 18, and 19 shall be completed if the article incorporates any material |

|

each foreign material used, or where a material is provided to the manufacturer without |

described in General Note 3(a)(iv)(B)(2), HTSUS, which is not considered "foreign |

|

charge, or at less than fair market value, the total of all expenses incurred in the growth, |

material" under General Note 3(a)(iv). Each such material shall be listed on a |

|

production, or manufacture of the material, including general expenses, plus an amount |

separate line. If no such materials are used, state "none" in column 17 and leave |

|

for profit; and (b) the |

columns 18 and 19 blank. |

|

|

|

|

|

|

EXCERPT FROM GENERAL NOTES, HARMONIZED TARIFF |

and all goods previously imported into the customs territory of the United States with |

|

|

SCHEDULE OF THE UNITED STATES |

payment of all applicable duties and taxes imposed upon or by reason of importation |

|

|

General Note 3(a)(iv) |

which were shipped from the United States, without remission, refund, or drawback of |

|

|

such duties or taxes, directly to the possession from which they are being returned |

|

(iv) |

Products of Insular Possessions |

by direct shipment, are exempt from duty. |

|

|

|

|

(A) Except as provided in additional U.S. note 5 of chapter 91and except as |

(B) in determining whether goods produced or manufactured in any such insular |

|

|

possession contain foreign materials to the value of more than 70 percent, no |

|

|

provided in additional U.S. note 2 of chapter 96, and except as provided in |

|

|

material shall be considered foreign which either - |

|

|

section 423 of the Tax Reform Act of 1986, goods imported from insular |

|

|

|

|

|

possessions of the United States which are outside the customs territory of the |

(1) at the time such goods are entered, or |

|

|

United States are subject to the rates of duty set forth in column 1 of the tariff |

|

|

|

schedule, except that all such goods the growth or product of any such |

(2) at the time such material is imported into the insular possession. |

|

|

possession, or manufactured or produced in any such possession from |

may be imported into the customs territory from a foreign country, and entered |

|

|

materials the growth, product or manufacture of any such possession or of the |

|

|

customs territory of the United States, or of both, which do not contain foreign |

free of duty; except that no goods containing material to which (2) of this |

|

|

materials to the value of more than 70 percent of their total value (or more |

subparagraph applies shall be exempt from duty under subparagraph (A) unless |

|

|

than 50 percent of their total value with respect to goods described in section |

adequate documentation is supplied to show that the material has been |

|

|

213(b) of the Caribbean Basin Economic Recovery Act), coming to the |

incorporated into such goods during the 18-month period after the date on which |

|

|

customs territory of the United States directly from any such possession, |

such material is imported into the insular possession. |

|

|

|

|